Cost assurance and audits on infrastructure projects and contracts

Part 5: Cost reporting

Jim McCluskey FCInstCES, Senior Commercial Manager, VINCI Construction UK Matt Yates, Project Commercial Manager, Buckingham Group and Cecelia Fadipe FCMA, Director, CFBL (Consulting)

THIS key output from the Multidisciplinary Steering Group for Cost Assurance and Audits on Infrastructure Projects and Contracts is on cost reporting and the records required for cost assurance and audits that will help minimise disallowed costs and risks on infrastructure projects and contracts.

Definitions

CICES defines cost reporting as the monitoring, reviewing and control of budgeted or agreed costs for construction projects, including reporting past performance and predicting future performance.

Competency in this requires the provision of financial assistance and statistical methods for analysing data for the economics of a construction project, including risk analysis and allocation.

The Royal Institution of Chartered Surveyors (RICS) states that the purpose of cost reporting is to inform clients of likely outturn project costs.

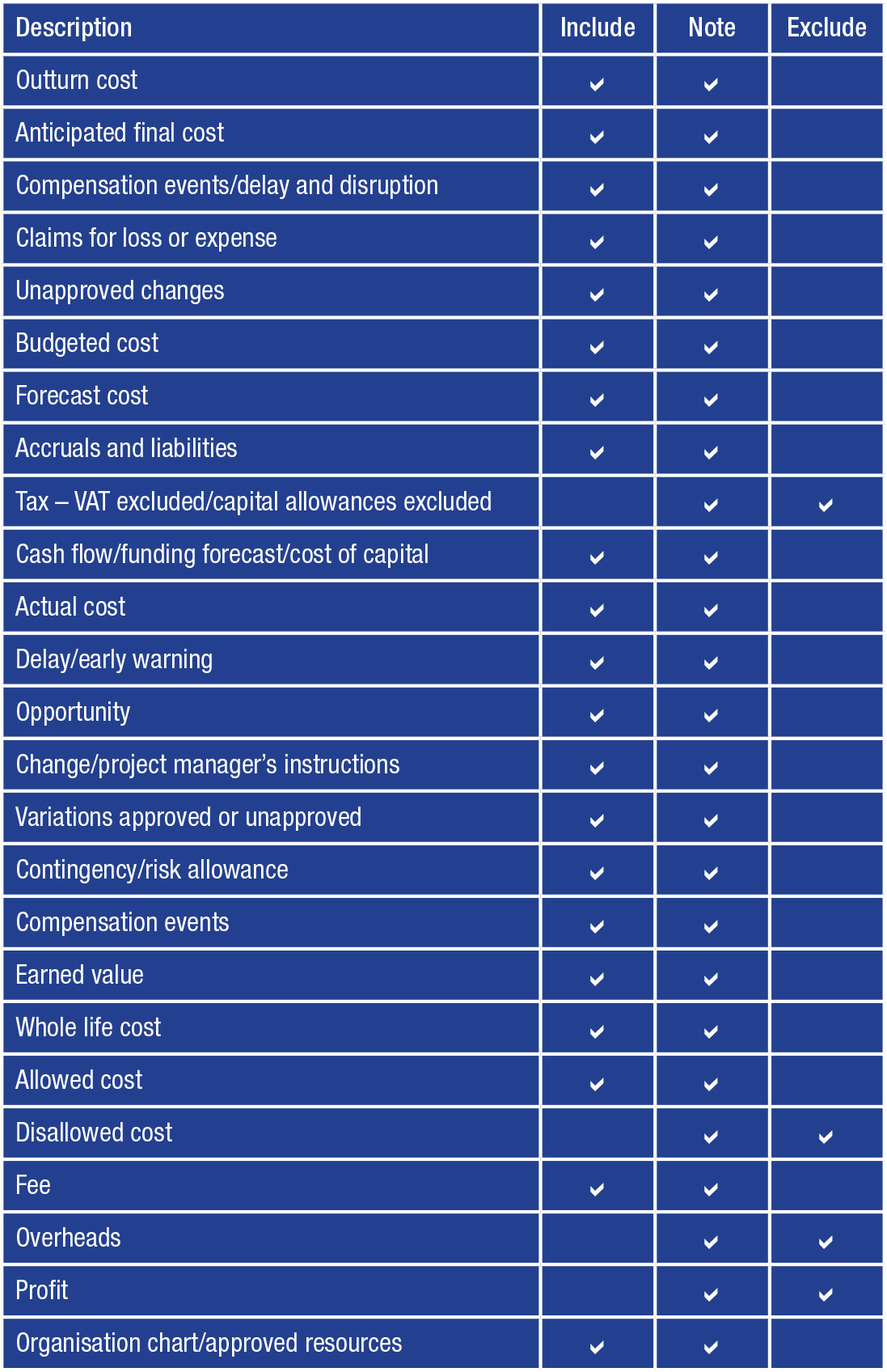

Forecast outturn cost may be expressed as a variance against budget or in absolute terms. A cost report should record costs as at the report date (where known and can be accurately valued), estimated forecast, cost changes, future cost changes and foreseen risk allowances under the contract.

The Chartered Institute of Management Accountants (CIMA) defines reporting as accounting for costs from the point where expenditure is incurred or committed (i.e. procurement) to their attribution to cost centres.

CIMA’s cost transformation model identifies six co-dependent areas for long-term cost-competitiveness and control:

- Cost-conscious culture

- Managing risks

- Cost drivers, accounting systems and processes

- Product profitability

- Sustainability

- Maximising value through innovation.

Cost reporting on construction contracts

Many clients, contractors and subcontractors tailor their cost reporting processes on New Engineering Contract (NEC) contracts, particularly option C, to allow the necessary transparency as required.

In general terms, client, contractor and subcontractor organisations should have prepared a commercial management plan (CMP) aligned to the NEC schedule of cost component (SCC) to ensure that cost collection, payment and reporting systems are compliant and provide the necessary level of detail required for third-party cost verification audits and independent assurance purposes on a project.

Reporting for people costs

People costs under NEC include both labour and staff costs. The SCC defines what is reimbursable as defined cost and by default what is not. The details below are considered essential to fulfilling these requirements.

Staff

Due to the sensitivity of the information that makes up staff cost (such as basic salary and bonuses) and potential data protection requirements, it is often expected that the staff cost identified in the cost report may not be readily identifiable per individual, or that the ‘cost’ used may be a calculated rate per individual.

This is relatively common practice, but care must be taken at the outset of the contract to ensure that all parties agree on the approach to be taken.

The production of annual average staff rates by role, for example, is generally considered an acceptable approach by some, but care must be taken to ensure that these are fully independently audited for validity and for potential disallowed cost inclusions.

Various approaches exist to deal with the use of sensitive data; whichever approach is taken must be supportable by an audit and agreed in advance to ensure that no conflict develops during the progress.

Many projects now opt to utilise advancements in technology, such as electronic time recording systems or biometric records for signing in and out of the site.

These can help limit the volume of auditing required and are recommended for use wherever possible.

Timesheets will also need to be completed detailing the tasks completed and the hours worked. These will need to be approved by an authorised person.

For staff cost reporting, this includes details of payroll or a schedule of agreed rates for all roles.

Consultant staff cost records for example should include details of the consultancy agreement, including agreed rates, validity period, basis of agreed rates, and a number of hours to be worked per day or details of how many hours would be considered to meet the requirements of a day rate or shift rate.

Common issues will include:

- The sensitivity of actual staff cost (salaries, bonuses and so on).

- Potential General Data Protection Regulation (GDPR) issues and conflicts.

- Payroll costs not readily available.

Labour

For directly employed labour, details of payroll and compliance with the SCC are required. This includes labour-only subcontractors. Requirements include details of labour only subcontracts with rates agreed per role, including what those rates may include or exclude.

The schedule of rates should also detail the rates to be applied for overtime, night shift and weekend work. The necessary authorisation of hours worked outside of the standard day shift needs to be detailed in the contractor’s delegated authority schedule.

In some cases, the project manager may be required to also pre-authorise these hours, and this may be prescribed in the works information. Most major projects will have electronic records or biometric systems which record the times upon which labour operatives have attended site. Allocation sheets and/or site diaries will need to be recorded detailing the tasks completed and the hours worked. These need approval by an authorised person.

Common issues will include:

- Training days, times and expenses may or may not be reimbursable depending on the wording of the SCC.

- Under NEC, the working area is usually defined in the works information. Payments of defined costs are made for works carried out in the agreed working area. Works carried outside of the working area will need to be approved by the project manager, for example manufacturing off-site, design and professional services.

- Lack of records or insufficient records supporting defined cost, such as missing timesheets, rate change details, evidence of approved overtime, allocation or diary sheets, and missing site records.

Subcontract costs

Wherever possible, the parties should develop an agreed procurement strategy for the project. This should identify the parties, the form of subcontract and approximate value. This allows the parties time to discuss the subcontract terms and any concerns.

Unfortunately, the construction industry still relies heavily upon the use of Microsoft Excel, but in the 21st century, this is flawed.An advanced draft copy of any subcontract terms should be issued to allow full review and comments. This ensures that the parties agree with the level of risk being procured or held by the project.

A detailed price breakdown should accompany the subcontract; with either direct coding or ‘mapping’ to align with Rail Method of Measurement (RMM) coding for acceptance and ease of future cost reporting.

Any advanced payment or structured payment mechanisms for manufacture, delivery, design or other, should be agreed and approved in advance of being incorporated into the subcontract terms.

Common issues will include:

- Potential rejection of proposed subcontract terms.

- Unacceptable level of risk in the subcontract agreement.

- Incomplete or missing price or internal fee breakdown and fee-on-fee.

Plant and equipment cost

Contracting organisations operating under cost-reimbursement contracts, for example, NEC option C or the Institution of Chemical Engineers (IChemE) Green Book, will need to ensure that the SCC and guidance are followed to record costs for reimbursement of defined costs. One of the primary considerations is to ensure that the best value is achieved in the procurement decisions made.

This should mean, for example, in the case of long-term requirements that a hire v purchase exercise is undertaken. This should demonstrate whether it is better commercially to either purchase and dispose of an asset, for example, a mechanical excavator, or whether hire is more cost-efficient.

Common issues will include:

- Plant and equipment which has been off-hired by the contractor is left onsite by the hirer and then invoiced.

- Repairs for wear and tear and damage can often accrue on projects. The contractor will need to have in place a process that will inspect and record the condition upon delivery, recording any obvious damage. This is vital in defending claims for payment for repairs.

- Responsibility for asset maintenance, i.e. oiling and greasing, servicing, needs to be clear at the point of hire or purchase.

- Delivery and collection costs need to be agreed upon from the outset.

- No asset management plan, asset register and process to recycle or reuse.

Cost reporting is vital to providing clients with cost certainty – and contractors with an accurate picture of the profitability of their works – and is the foundation of assessing the success of a project/company and communicating these with supporting evidence.

Ensuring your commercial team understands and complies with how cost reporting is to be carried out (commercial procedures), what the information is used for and how that information may impact decision making on a business level is important to encourage appropriate behaviours and compliance within the team. Ensuring costs are captured correctly and are reported promptly can impact forecasting, understanding of cash position, and strategic level budgeting.

Transparency within cost reporting and adequate stress tests can help management/finance properly understand emerging risks that are likely to have a cost implication and impact their position.

As noted within the body of this article, an early understanding of what costs are claimable (for example, defined costs) and which costs are not (for example, covered by the fee) can avoid difficulties in parties having a difference of opinion as to the cost and value of a project/framework, and decisions being made based on erroneous information. Therefore consistent and open communication both internally and externally is recommended.

Kathleen Hannon, Scottish Water

Design costs

Designers are often engaged on professional services agreements (PSA) which should detail the following:

- Scope of works to be performed including the required deliverables, for example design drawings, consultants’ prices for delivering the scope of works.

- Consultants’ rates for various design personnel such as principal designer, senior design engineer, design engineer. The basis of these rates should be stipulated in the PSA, covering what the rates include, exclude and what is chargeable or not.

Common issues will include:

- Unclear scope of works and consequently moving design targets.

- Control and authorisation of design hours expended in the UK and globally.

- Hours expended exceeding hours budgeted or quoted by the consultant.

- Lack of acceptance of the quality of completed design deliverables.

- Promotion of staff by a consultancy to allow charging a higher rate.

- Non or delayed performance of deliverables by consultants.

- Work carried outside the working area.

- Verification of additional charges by consultant, such as travel, overtime, administration.

Sundry costs

Sundry costs can include the cost areas which do not quite fit into the people, plant, equipment and material categories and can often be categorised in the preliminaries section of the budget. However, confusion may arise in terms of whether such cost qualifies for payment of the defined cost or whether it is deemed included in the fee. Costs include payments for business rates, planning fees, purchase or lease of land or property, first aid, utilities, catering, community liaison and landfill tax.

Common issues will include:

- Specialist services, including legal advice financing and bank charges, IT costs.

- Insurances.

Materials cost

Difficulties can arise by inaccurately cost coding and reporting location and type of work. Discussions in advance are advocated to help ascertain the correct level of accuracy required and where, for example, common construction materials are delivered in bulk but utilised across multiple projects or sites (such as type 1 stone or concrete).

Orders will commonly use only one cost code for bulk delivery, this creates additional work for both site and accounting teams if these are required to be broken down at the point of invoicing. Alternatives may be acceptable such as retrospective calculations based on designed volumes.

Where the project is considering the use of internal/intergroup supply of materials, care should be taken to obtain prior approval. This includes open discussions about chargeable costs, internal fees and consideration for records required for evidencing value for money as a priority, alongside ensuring that no unagreed profit or fee-on-fee is reoccurring.

Common issues will include:

- Bulk material purchases for multiple projects with incomplete project-specific records.

- Inaccurately cost coding, accounting and reporting by location and type of work.

- Evidencing value for money and the absence of fee-on-fee with internal company supplies.

Insurance

Insurances are complex because they may be embedded and reported across various cost components for staff, general, sundry, plant and materials, some of which are defined costs and some in the fee. Firstly, consideration must be made for whether the insurance is a recoverable cost (or disallowed) under the contract. Assuming this is the case, a second complexity can arise as businesses often purchase insurance packages in bulk.

Care must be taken to ensure that an appropriate allocation basis or cost driver is used and that the correct sum is allocated to the right project when an annual insurance cost is apportioned across multiple projects.

Common issues will include:

- Some insurances are disallowed or paid for in the fee inclusion of overheads in the allocation of insurance costs in group-wide policies for multiple insurances.

- No distinction between project and general insurances.

Fee

Whilst fee itself is not a ‘cost’ to be reported, care should be taken to ensure accuracy of calculation, reporting and compliance with the contractual terms. Difficulties can arise, for instance, where staff cost rates may include elements of insurance costs, IT costs or training allowances which may not always be recoverable. By identifying these early, the correct adjustments can be made during the natural progress of the contract in the full awareness and acceptance of all parties.

Care should be taken to only apply the fee to the allowable costs under the contract, working exclusively of VAT. A breakdown of the fee and percentage allocation including the disallowed costs in the fee should be visible in the contract.

Common issues will include:

- Incorrect fee calculation.

- Fee-based costs included in other cost categories.

- Multiple and complex fee structures incorrectly applied.

- Lack of clarity on what is paid in the fee and what is excluded.

- Excessively low fees incapable of supporting budgeted overheads and profits.

Robust cost reporting is one of many critical factors to successfully deliver a project providing an accurate picture of cost expended to date and future commitment. Achieving high levels of accuracy and consistency in cost reporting provides confidence to stakeholders that the project is under control in a world that is typically fixated on cost performance. Early reporting of budget pressures and shortfalls is also critical to allow management to review and action.

Accurate cost reporting requires a full understanding of the contract requirements to ensure proper compliance with terms. Finessing reporting requirements should be an early exercise between client and contractor ideally pre-contract on commencement of the project. The use of an independent party to assess the quality of the contractor’s data, systems and cost information is a robust way to provide early assurance and avoid challenges and disallowed costs further down the line.

The importance of reviewing Tier 2 and 3’s capability in providing robust and accurate cost information should also not be understated or overlooked as the size and scale of projects increase.

Imran Akhtar, Director, Turner & Townsend

Charges and levies

On most projects, overhead and general costs such as IT, mobile phones and insurances are budgeted for. Assumptions have been made before the tender stage as to whether the actual cost for these will be an overhead cost that is fee-based or recoverable from the project.

These costs once incurred are then invoiced monthly or annually to head office or group in one invoice (largely because it is easier or more cost-efficient to do so) that is reallocated as charges or levies across projects using appropriate cost drivers such as hours, contract value or headcount.

There is a need to ensure that costs for people, equipment or services deemed as overhead costs are not included in the build-up of charges or levies. For example private medical insurance, a defined cost, included in general insurance, a fee-based cost. The cost drivers used to reallocate and recover these costs from the project should be pre-agreed with the client or contractor to minimise disallowed cost surprises.

The allocation mechanism may be the contract value or a suitable cost driver such as hours recorded in the timesheet system. The level of detail is crucial and should be specified on commencement. Pre-agreeing set protocols for cost reporting will enable the parties to maintain control of costs without being overburdened with reporting as intended by the contract.

Common issues will include:

- Incorrect recovery assumptions.

- No visibility of charges and levies build up until an independent audit.

- Overhead cost and time allocated to the project.

Rebates, credits, and volume reduction discounts

Rebates from economies of scale from bulk purchases on major contracts could run into millions of pounds from the purchasing of plant, material and labour. The contractor may feel entitled to these if retaining these credits is a company strategy and if resources deemed to be overhead costs have been expended in negotiating it.

Examples include trade discounts, settlement discounts and other rebates. Accounting for these reductions will vary depending on the type of contract or alliancing arrangement. Should these benefits be shared in pain/gain arrangements by crediting the benefit back into the project account?

Pre-agreeing the purchasing strategy, including how rebates, credits and volume reduction discounts for costs such as plant, materials and site labour should be treated, is vital.

Protocols should be pre-agreed from the onset to ensure that projects remain profitable and viable for suppliers. In most instances, purchases for materials would have been negotiated and undertaken centrally at group level by the strategic procurement team. This means that any credits due back are likely to be absorbed back centrally by the business, unless expressly specified in the contract.

If this is the case similarly credits should be reallocated back to the project using an agreed allocation mechanism such as contract value, quantity of purchases, or hours worked.

Financial records and assumptions used for reallocation should form part of monthly cost reporting. Initial checks should be undertaken by the commercial team to confirm the volumes and accuracy of credits in the payment application.

There may be a requirement for cost reports evidencing credits from discounts. Cost reports may include records from the project bank account, purchase orders and invoices to verify the accuracy of rebate values.

Common issues will include:

- Increased group company scrutiny and responsibility to evidence value for money.

- Group company or internal cost centre charges a fee deemed as a fee-on-fee.

- Group strategy’s intergroup supply fee not pre-agreed in the contract.

- Treatment of rebates benefit subject to misinterpretation.

Overheads

Overhead costs are often non-project-specific costs that cannot be directly attributed to the works or resources used on a project. Overheads may be fixed, or variable expenditures that are required for maintaining the operations of a business but cannot be suitably ascribed to a cost centre or unit. Functions such as commercial, procurement and finance are examples of overhead functions and costs such as legal fees are often deemed included in or paid for by the fee.

Therefore, unless the cost for a person working in these functions is pre-agreed and designated for the works in an approved working area, such costs incurred in these areas may be disallowed.

Where it can be evidenced that an individual has undertaken work on the project, it may be possible to obtain authorisation in lieu – although there is a risk that not all may be allowed and recoverable. The recovery of costs for such individuals may have been budgeted against the project. Cost reports should include the role designation, timesheets and allocation records for charges and levies.

Similarly, where the cost for an approved listed member of staff or designated role is included in the payment application, if the build-up of staff cost rate includes overhead costs such as IT, mobiles and training, the cost and time spent undertaking training will be disallowed unless it relates to pre-agreed project-specific training.

Cost reporting should include an up-to-date list of approved resources in the staff, labour and subcontract organisations (redacted for sensitive information) to evidence that there is no duplication and that the designation is accurate. In addition, on a contract where the contract fee percentage varies depending on the cost category, separate detailed cost records need to be maintained.

An electronic timesheet system for staff, subcontractors and biometrics signing in and out records for safety and control of site labour should be readily available evidence.

With time being such an important cost driver, complete, arcuately maintained and approved timesheets for the staff or labour overtime or weekend worked is vital for defined costs.

Common issues will include:

- Budgeting incorrectly the recovery of general overheads.

- Incorrect interpretation and assumption on fee, overhead costs and functions.

- Attempting to recover time spent on overhead activities within defined cost.

Robust and accurate cost reporting is an essential component for all parties involved in a construction contract. It is critical to deliver a project within the budget and to inform decisions about the cost of change, providing all parties with an opportunity to mitigate potential cost increases.

Unfortunately, the construction industry still relies heavily upon the use of Microsoft Excel, but in the 21st century, this is flawed, as inherently Excel involves multiple spreadsheets from multiple sources being combined into reports for internal and external reporting. The industry needs to look to the future and start using cost reporting software that can import the budget, update the costs based on award values and manage the change process, all within the same system, allowing up to date and real-time reporting to be undertaken at any time during the periodic reporting cycle to provide better controls and that all-important information required to make decisions. Successful cost reporting should always be based on the latest available information.

Mark Harvey MCInstCES, Head of Procurement, London Underground

Value for money

Once delivery ramps up, it can be challenging managing the volume of records and controlling costs due to the sheer scale of cost data involved versus limited resources. Some steps can be taken to mitigate this. The cost culture of a business should be evident on the project from the organisation’s cost assurance strategy, communicated via supplier engagement and in tender documents.

In the contract, steps should have been taken to pre-notify the extent of cost reporting requirements for managing risks. Cost drivers should be actively managed through the scrutiny of variances in cost reports, such as actual, budgeted, forecast cost, time and quantities used on the project. Cost estimates and assumptions used to set budgets and contract values should be realistic in the first instance.

The integrity of the project account rests on compliance to accounting standards and the use of reliable financial, commercial, and project governance control systems. When there is a breakdown of these or when they exist but are ineffective, the resulting cumulative effect of overcharges and significant cost overruns are not uncommon on most projects.

Today, these are being worsened by emerging risks such as carbon, COVID-19 and Brexit-related pressures that have resulted in scarcity in the supply of natural and human resources and an increase in the cost of raw materials. These pressures mean that sustainability and maximising value through innovation are unavoidable KPIs that are the collective responsibility of clients, contractors and their supply or value chains and should be part of monthly cost reporting.

Therefore, governance structures should be in place for assurance and transparency to ensure that lessons are learned, protocols are implemented and robust cost reporting records that can be audited independently are in place to mitigate cost pressures, change behaviours and drive value for money early on projects.

Common issues will include:

- Parties not taking responsibility for evidencing value for money.

- Attempting to transfer risk to other parties by reporting costs incorrectly.

- Not maintaining adequate records for evidencing value for money.

Emerging costs

Environmental factors, such as the UK’s target to reduce greenhouse gas emissions to set science-based targets to achieve net zero by 2050, will impact cost reporting on infrastructure and construction projects due to increased compliance requirements.

Risks associated with climate change mean that safety associated with the design of infrastructure and raw materials will become more unpredictable. As a result of increased risks, such as flooding and fires, these will need to be priced into contracts, making projects more expensive. Increased social scrutiny means increased reporting of equality, diversity, inclusion KPIs. Examples include reporting the gender pay gap, board diversity and fair competition for SME businesses.

The integrity of the project account rests on compliance to accounting standards and the use of reliable financial, commercial, and project governance control systems.Stakeholders are pushing for increased governance, transparency and value for money from projects like HS2. This will include sustainability reporting and evidencing climate-friendly designs and raw materials as part of monthly cost reporting.

The Emissions Trading Scheme (ETS) is transforming the industry into a more responsible investor-driven market that is concerned with the impact the construction of infrastructure like HS2 will have on the sustainability of local communities.

To be more impactful, clients are increasing third-party engagement and collaboration with supply and value chains to achieve environmental targets.

By using an extended balanced scorecard in reporting to include environmental, social and governance (ESG) KPIs and a carbon footprint cost reporting tool, such as Compare your Footprint, this can be seamlessly achieved. Contractors such as J Coffey have already successfully implemented this.

Innovating and using building information modelling (BIM) technology and modular designs where possible will streamline cost, while automated software, such as Raildiary, capable of

capturing cost data at source while incorporating visualisation, benchmarking and trend analysis will also help improve cost reporting and provide intelligence for future decisions.

Common issues will include:

- Establishing risk ownership.

- Increased demand and scrutiny from stakeholders.

- Changing consumer and people behaviours.

- Data capture, benchmarking and innovation.

Other factors influencing cost reporting

Budget, actual and forecast cost variances On projects, actual cost to date and other risk factors often influence forecast outturn cost. The most significant variable is unforeseen risks and change. The actual cost to date compared to budget and the previous month’s forecast will result in a variance. The cost report should include movements in predicted actual cost and forecast to complete from the prior month’s report with explanations and substantiation for variances. Over time, these will Impact costs, resulting in budget overruns, increased budget and, in some cases, re-authority where this exceeds funding thresholds. These are fundamental aspects of cost reporting on infrastructure projects.

Original contract sum, change and revised contract sum

Compared to the original contract sum, percentage completion to date and forecast to complete may result in negative earned value and an increased cost and time to

complete. This can result in a claim or extension of time. Unforeseen risks or opportunities, planned change or future change (to the works or to a cost driver such as rate, quantity or time) that result in an approved change to scope will result in a variation to the original contract value.

These are the primary reasons for the variations to final outturn costs or budget overruns and as a result they should form part of cost reporting for management, clients or funders.

Compliance to cost reporting standards, contract and frameworks

Cost reporting and control systems are required for compliance to International Financial Reporting Standards (IFRS) for the correct accounting and reporting treatment. In NEC the contract cost for works is the contract sum, but under the New Rules of Measurement (NRM) the cost of work to be agreed is a post-tender estimate.

Could the current state of flux, increased risk and shorter duration of projects mean a need for more frequent weekly or fortnightly reporting to better inform commercial decisions? Also, is there a need for standardised cost reporting?

There may also be specific protocols agreed between the client and other parties such as funders, procurement, designers, contractors or asset managers. Network Rail’s RMM aims to provide comparative measurement, valuation and analysis of railway engineering construction projects.

Funders may expect reports in a different standard format. The International Cost Management Standard (ICMS) provides some guidance to enable reporting of costs across the whole life of a project, attempting to eliminate inconsistencies in accounting, comparing and forecasting the project cost. In an independent cost audit, these controls will be tested via the scrutiny of reports for key costs.

Cost reporting in practice

There is no standard form of cost reporting, although most professions and businesses have a preferred format where industry, client or contract specific requirements do not exist depending on the type of contract, such as fixed price lump sum, target cost with pain/gain, cost reimbursable remeasurable, fixed fee, variable fee, trade, and professional services contracts.

The UK construction industry’s best practice cycle is monthly reporting aligning with the monthly application for payment. Could the current state of flux, increased risk and shorter duration of projects mean a need for more frequent weekly or fortnightly reporting to better inform commercial decisions? Also, is there a need for standardised cost reporting?

Some industries, clients and contracts require specific cost and digital systems for capturing and reporting carbon cost data at source as part of environmental and sustainability reporting. The Sustainability Accounting Standards Board (SASB) and Task Force on Climate-Related Financial Disclosures (TCFD) both set guidelines for disclosures which should ideally be incorporated into monthly cost reporting.

Common issues will include:

- The complexity of cost coding makes alignment and the use of standard coding challenging.

- Requirements are not always aligned to internal operations, and codes are not transferable.

- The quality of cost coding varies depending on project size, because the time and effort required to correctly set up codes at inception is costly, and is mostly beneficial on long-term projects.

- RMM is complicated, this means that it is only somewhat useful and not being fully utilised because it takes time to breakdown in the accounting system.

- Additional resources are unavailable to cope with complicated cost coding and records. This results in shortcuts in requisitioning and incorrect coding errors as the point of least resistance is used.

- Tender cost reporting demands may be unfit for delivery. Pre-agree at project start and include the employer in discussions, as many client requirements operate quite differently.

- Large projects have resources to improve accuracy, but limited resources will impact the level of detail and accuracy of cost records, hence a cost-benefit trade-off between accuracy and staff cost.

- An optimum staffing level to provide value engineering results in a cost trade-off. Technology with standardised, flexible cost systems is required to improve cost reporting.

The role of commercial finance and project teams

Cost reports include information on the cost to date, forecast, accruals and liabilities from other parties such as contractors and subcontractors that have been relied upon in determining forecast outturn cost. The accuracy and degree to which we can rely on these depends on the competency of internal and third-party teams.

Cost assurance audits test the validity of assumptions used to establish actual cost, forecast and liabilities. The accuracy of the cost coding architecture and accounting records in the financial system needs independent verification by a qualified accountant, valuations and quantities are best tested by a qualified surveyor, while risk and completion costs will require the project manager/engineer’s expertise.

Furthermore, some cost reports will exclude confidential or commercially sensitive data that is not presented as part of monthly cost reporting and payment applications, such as payroll and rate buildup data. The validity of such sensitive data is best determined by an independent and experienced cost auditor.

Jim McCluskey FCInstCES, Senior Commercial Manager, VINCI Construction UK, Matt Yates, Project Commercial Manager, Buckingham Group and Cecelia Fadipe FCMA, Director, CFBL (Consulting)

Jim.McCluskey@vinciconstruction.co.uk cecelia.fadipe@cfbusinesslinks.com matt.yates@buckinghamgroup.co.uk

The Multidisciplinary Steering Group on Cost Assurance and Audits on Infrastructure Projects and Contracts:

Cecelia Fadipe (chair), CFBL Consulting; Imran Akhtar, Turner & Townsend; Michael Bamber, Capita; Gary Bone, Blake Newport; Adrian Charlton, Atkins/SNC Lavalin; Kathleen Hannon, Scottish Water; Mark Harvey, Crossrail-Transport for London; Chris Haworth, Ridge & Partners; Ian Heaphy, IN Construction, NEC Contract Board; David Heath, Atkins/SNC Lavalin; Victoria Hill-Stanford, Network Rail; Charlotte Hughes, Eversheds Sutherland; Tom Leach, Southern Water; Jim McCluskey (CICES representative), Vinci; Lisa O’Toole, Network Rail (HS2); Elliot Patsanza, Ridge & Partners; Paul Railton, The Orange Partnership; Claire Randall-Smith, Eversheds Sutherland; Matt Yates, Buckingham Group