The UK’s top 100 construction companies

Mark Coates, International Director of Public Policy and Advocacy, and Matt Cox, Account Manager – Northern Europe, Bentley Systems

THE turnover in the UK’s 100 largest construction companies has increased by more than 14% over a decade to reach more than £70bn a year, according to analysis by Be The Best Communications’ People, Places, Policy and Data Unit on behalf of Bentley Systems. Over that same time, the collective annual profit of the UK’s largest construction firms rose by more than 66%, from £790.8m in 2013 to £1.31bn in 2022.

Average profit margin of the top 100 contract over the past 10 years was just 1.6%. However, average profit margins have increased significantly over the past decade. From 2013 to 2017, the average profit margin of the top 100 was just 1.18%. From 2018 to 2022, the average profit margin has almost doubled to 2.02% – an increase in margin of more than 70%.

Homeserve recorded the largest profit in 2022 with £175m, followed by Morgan Sindall with £162m, Balfour Beatty with £87m, Skanska with £73m, and Keller Group with £72m. The only contractors to record double-digit profit margins in 2022 were Homeserve, Watkin Jones Plc, FP McCann, HG Construction, Henry Boot, HW Martin, and RJ Mcleod.

Average profit margin of the top 100 contract over the past 10 years was just 1.6%. However, average profit margins have increased significantly over the past decade. The number of £1bn-turnover construction companies has risen by 29% over the past decade, from 17 in 2013 to 22 in 2022.

Indeed, 2022 is the first time that the UK has had 20 or more £1bn contractors. Among the contractors joining or re-joining the £1bn club in 2022 are Sir Robert McAlpine, BAM Nuttall, Costain, and Vinci Plc. Only 14 of the top 100 construction companies registered a loss in the 2022 analysis of accounts, compared to 25 in 2021.

Be The Best Communications and Bentley’s analysis used The Construction Index’s annual analysis of the UK’s top 100 construction companies between 2013 and 2022, based on accounts filed at Companies House.

The fastest growing construction companies of the past 10 years include:

- Graham Construction, which saw turnover increase by 258% over the past decade from £264.2m in 2013 to £948.3m in 2022.

- Multiplex, which enjoyed a 256% increase in turnover from £222.3m to £793m.

- Renew Holdings, which reported 134% increase in turnover from £337.4m to £791m.

- McLaughlin & Harvey, which has experienced a 219% rise in turnover from £150.6m to £480.3m.

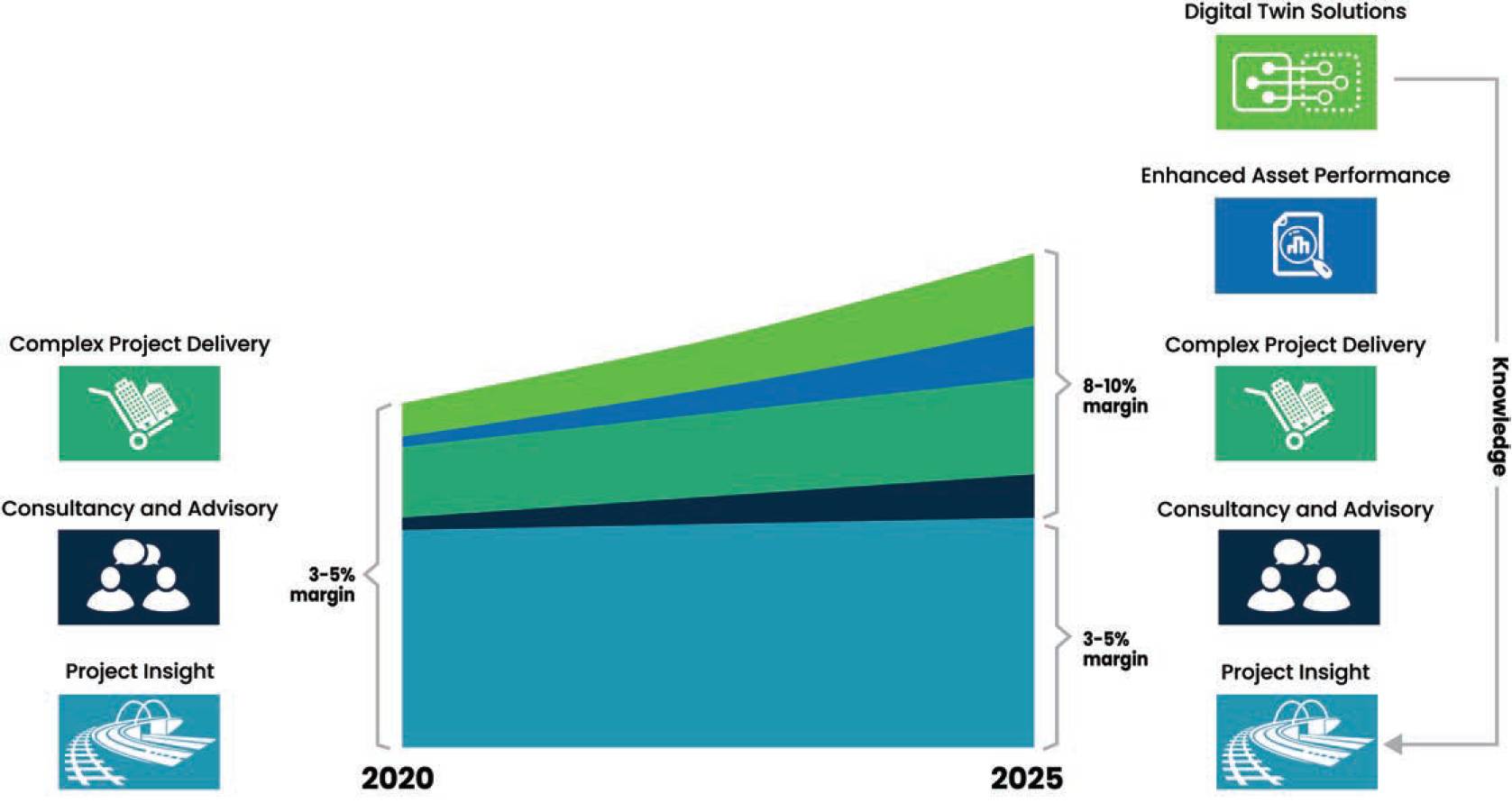

Figure 1: Profit margins will increase further as firms learn to leverage the power of data.

Indeed, McLaughlin & Harvey are now part of one of the fastest growing bands of contractors in the UK, with the midsize contractor recording turnover between £400m to £600m.

Having a longer-term relationship is in the best interest for all parties – the contractor, consultant, and client. It means additional income streams for the contractor and consultant over longer time periods.In 2013, there were only six companies reporting turnover between these bandings. By 2022, that figure had increased by 150% to 15 companies. It now includes Ferrovial, Watkin Jones Plc, Severfield Plc, Henry Construction, Bouygues UK, and Lendlease. It also includes fast-growing contractors like TSL Ltd, which saw turnover increase by 57% from £348.2m in 2021 to £548m in 2022, and Hill Partnerships, which saw a turnover rise by a quarter from £346.5m to £431.5m.

While profit margins of the UK’s top 100 construction companies has almost doubled over the past decade, analysis by international consultant Turner & Townsend found that the UK and other major English-speaking countries have the world’s lowest profit margins.

Turner & Townsend’s International Construction Market Survey 2021 asked a sample of firms in 90 worldwide markets to provide typical profit margins on a medium-sized commercial job. It found that the UK had the lowest margins at 3.9%, followed by Australia and New Zealand at 4.5%, and North America at 4.6%. In contrast, profit margins in continental Europe stood at 6.1%.

Bentley Systems states that construction companies can increase their profit margin in future years by leveraging the level of insight that data gives them into construction projects so that they can advise how to improve the performance of that asset over future years. In fact, last year, we published a white paper ‘The power of data for long-lasting change’.

Digital director at the Centre for Digital Built Britain, Mark Enzer has stated that making better use of asset and systems data is central to this vision. Mr Enzer advised that better analysis of better data enables better decisions, producing better outcomes and is something that promises to improve the way that organisations function, the delivery of new assets and the operation, maintenance, and use of existing assets.

Several delivery partners are now looking at extending these relationships in what we have coined ‘x +10 or 20’.Digital assets, such as data, information, algorithms, and digital twins, should also, he recommends, be recognised as genuine assets that have value and must be managed effectively and securely, leading in time, for these digital assets to become valued and connected data seen as infrastructure.

Having a longer-term relationship is in the best interest for all parties – the contractor, consultant, and client. It means additional income streams for the contractor and consultant over longer time periods.

Several delivery partners are now looking at extending these relationships in what we have coined ‘x +10 or 20’, where x equals the length of a project and 10 or 20 equates the number of additional years that they could be employed to manage the asset. For the client, they can hold the delivery team accountable and deal with the people who know the asset best.

While it is heartening to see the profit margin of the top 100 construction companies doubling, Bentley states that profit margins will increase further as firms learn to leverage the power of data.

Mark Coates, International Director of Public Policy and Advocacy, and Matt Cox, Account Manager – Northern Europe, Bentley Systems